Update on our PE Investment: VEEA Merges with Plum Acquisition

We are thrilled to announce that our PE fund's portfolio company VEEA has submitted a proxy statement and prospectus together with Plum Acquisition I in April this year, outlining the proposed merger of Plum and VEEA. The transaction values the combined entity at approximately $281 million, with VEEA previously expected to raise $50 million in private financing and assuming the redemption of certain Plum shares.

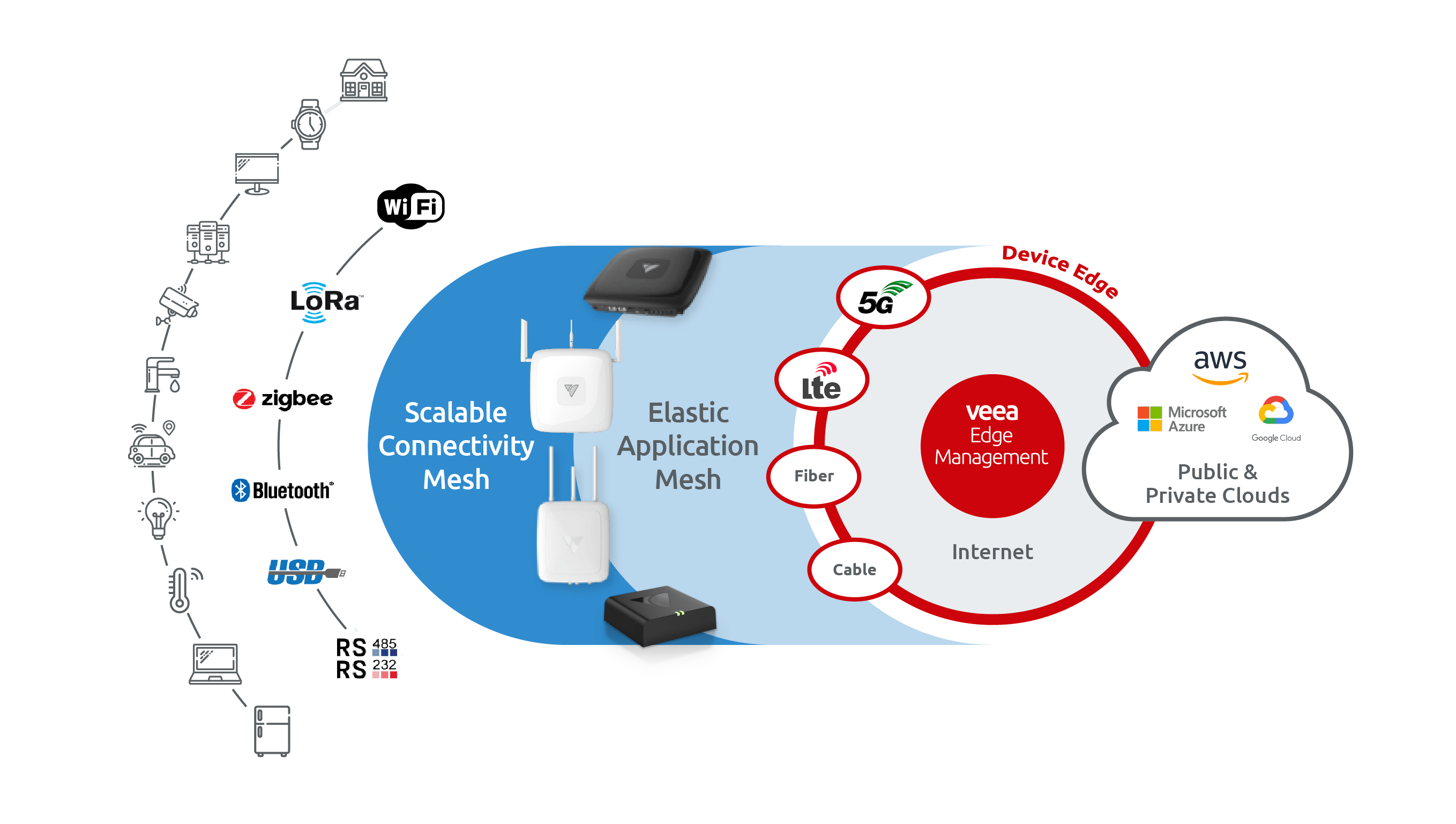

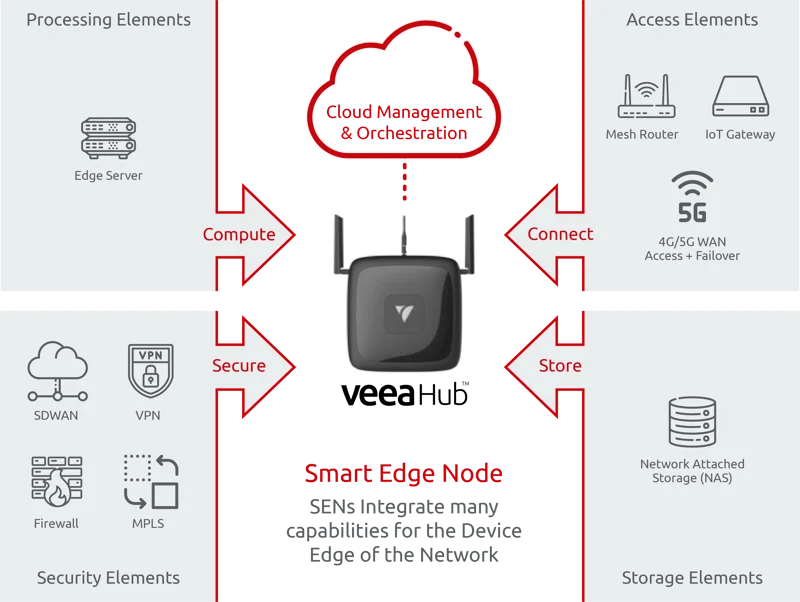

Founded in 2014, VEEA provides edge-to-cloud computing through its VeeaHub smart computing hubs, which can replace or complement WiFi access points (APs), IoT gateways, routers, basic firewalls, network-attached storage, and other types of on-premises hubs and devices. VEEA's cloud-managed VeeaHub products and their edge applications are core to the company's mission of driving digital transformation across industries. VEEA's edge computing products can serve potential customers across multiple sectors.

VEEA's plug-and-play smart hub products integrate computing and communications capabilities, enabling customers to securely access always-on critical digital applications locally at the user or device edge with low latency, privacy, and data ownership - provided that all things are first connected to the internet.

VEEA was founded and led by wireless technology pioneer Allen Salmasi. Salmasi's contributions to the development of CDMA/TDMA-based OmniTRACS, one of the largest mobile satellite messaging and location reporting systems in the 1980s with integrated IoT solutions, helped drive industry transformation. He then went on to contribute to Qualcomm's CDMA-based 2G/3G technologies and products in the 1990s, NextWave's OFDMA-based 4G technologies and products in the 2000s, and hyperconverged edge computing and communications in the 2010s.

The consideration for this merger transaction will include newly issued Plum securities, priced based on the pre-money equity value of VEEA's outstanding securities, as well as certain outstanding debt that will convert to equity at closing, totaling approximately $194 million (excluding any funding raised by VEEA since 2017).

VEEA believes that the merger with Plum will accelerate the deployment of its highly scalable hyperconverged edge computing and communications solutions across multiple industries, including providing digital communications services to unserved populations in remote regions globally. Additionally, the business combination will enable VEEA to leverage its first-mover advantage and deliver industry-leading solutions based on a virtual trusted broadband access (vTBA) platform, which brings IP-addressable WiFi and IoT device and sensor network management, including cellular devices, subscription services, and seamless roaming across VeeaHub coverage areas.

Furthermore, the holders of VEEA's capital stock at the time of the business combination (excluding holders of securities issued in VEEA's current financing) will be entitled to contingent rights to receive up to 4.5 million shares of the combined company's common stock over a 10-year period post-closing, subject to the achievement of certain milestone conditions based on the transaction price, as stipulated in the Business Combination Agreement.

We are honored to have been part of VEEA's journey, and we are grateful for the years of dedication and perseverance by the company's management in achieving their technological roadmap. We wish the de-SPAC merger with PLUM the utmost success.

Source: Official media/online news