Our PE Investment - Palantir’s Revenue Surge Driven by AI Technology

On August 6th, Palantir released its second-quarter earnings report that exceeded expectations and significantly raised its annual profit outlook, resulting in a strong market reaction. Palantir's stock price surged 10.38%, reaching as high as 14% intraday. The stock has accumulated a 54.86% increase since the beginning of the year, primarily driven by the robust global demand for its artificial intelligence software products from both government agencies and enterprises.

Highlights of the Financial Report

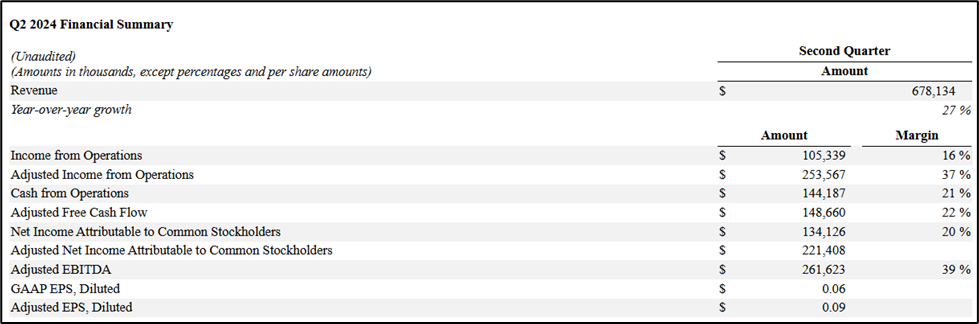

• Q2 Revenue grew 27% year-over-year to $678 million.

• Q2 Commercial revenue grew 33% year-over-year to $307 million.

• Q2 Government revenue grew 23% year-over-year to $371 million, exceeding the expected $347 million.

• Q2 net income unexpectedly grew 20% to $134 million, exceeding expectations of $82.8 million.

• Q2 earnings per share increased 500% year-over-year to $0.06, with adjusted EPS up 80% year-over-year to $0.09.

• 2024 revenue guidance raised to $27.4 - $27.5 billion, exceeding the expected $27 billion.

• Adjusted operating profit for this year rose to $966 - $974 million, exceeding the expected $883 million.

Source: Palantir Technologies Inc. Q2 2024 Earning Report

Outstanding Performance of Core Business

Palantir's main business is divided into government business and commercial business. In the second quarter, the company's total revenue grew 27% year-over-year to $678 million, exceeding the $652.8 million expected by Wall Street analysts. Net income unexpectedly grew 20% to $134 million, much higher than the $82.8 million which analysts had previously expected. Palantir's second-quarter adjusted EBITDA reached $262 million, a substantial 39% year-over-year increase.

In the second quarter, Palantir's government business continued to maintain growth momentum, with government segment revenue growing 23% year-over-year, primarily driven by contract with the U.S. Department of Defense. In the short term, government demand contributes more to Palantir's revenue. Given the global situation intensification and the digitization needs of the defense system, Palantir has secured multiple US military contracts this year, boosting the overall growth of government revenue.

Meanwhile, Palantir's commercial segment revenue grew by 33%, delivering an outstanding performance. Since the launch of Palantir's AIP (Artificial Intelligence Platform), it has become a crucial driver for sustained high growth in commercial revenue in less than a year. The AIP platform helps clients efficiently leverage Palantir's various functionalities through user-friendly interfaces and powerful data analytics. These features make it highly appealing to enterprises that seek to deploy AI solutions but lack the necessary technical resources, especially in industries that require managing large datasets and complex decision-making. Additionally, Palantir's successful training programs have enabled the company to expand its commercial client base. With the application of AIP in real-world scenarios such as supply chain, marketing, and human resources, Palantir successfully wins multiple commercial projects, leading to an 83% year-over-year increase in the number of U.S. commercial clients.

Driven by the strong growth in commercial and government business, Palantir achieved a 22% year-over-year increase in free cash flow in the second quarter, indicating a solid performance. This means that Palantir's profitability is constantly improving, and its abundant cash flow provides the company with more financial flexibility and capital support. This can be used for further investment and expansion to enhance the company's market competitiveness, while also reducing the company's reliance on external financing and improving its financial security.

Outlook for Q2 Financial Data far exceeds Expectations

In terms of the most closely watched performance outlook, Palantir has significantly raised its full-year guidance, with a larger increase compared to the first quarter. Palantir has unexpectedly raised its 2024 total revenue guidance range to $2.74-$2.75 billion, exceeding the expected $2.7 billion. The company has also significantly raised its adjusted operating profit outlook range for this year to $966-$974 million, and the adjusted free cash flow for fiscal year 2024 is expected to continue growing to $800 - $1 billion, far exceeding analyst expectations.

Furthermore, Palantir's Chief Financial Officer, David Glazer, stated that "based on these strong financial results, we will be eligible to become a significant component of the S&P index." He was referring to the company's possible inclusion in the S&P 500 index, which would undoubtedly further boost the market's positive sentiment towards Palantir.

Source: Palantir Technologies Inc. Q2 2024 Earning Report

Reference Source:

Palantir Technologies Inc.

Zhitong Finance

Yahoo Finance

The Wall Street Journal